What is a W-9 form?

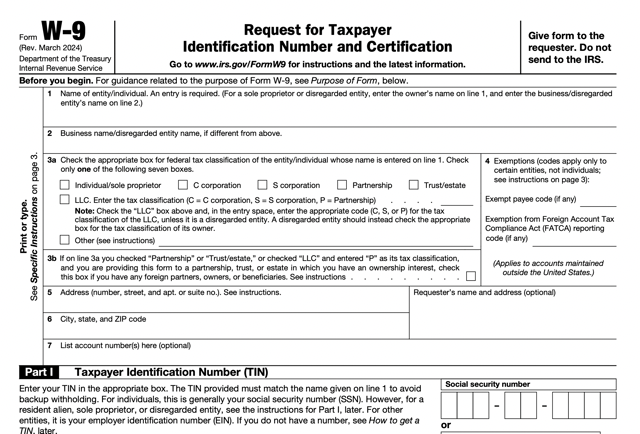

The W-9 form is essential for anyone who works as a freelancer, independent contractor, or any entity receiving payments for services. It's used to provide your Taxpayer Identification Number (TIN) to entities who pay you, ensuring the correct reporting of taxes to the IRS. This form helps manage your tax obligations efficiently, avoiding potential issues with tax withholdings and reporting.

What is a W-9 form used for?

Filling out a W-9 form is essential for accurate tax documentation. Here's what it's used for:

- To provide your taxpayer identification number to entities who pay you.

- To certify your tax status as a U.S. person.

- To claim exemption from backup withholding if applicable.

How to fill out a W-9 form?

- 1

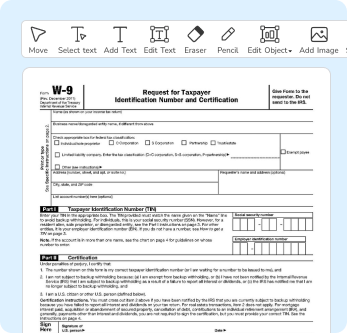

Open the W-9 form in the editor.

- 2

Fill in your name as shown on your tax return.

- 3

Enter your business name/entity if different from above.

- 4

Select the appropriate tax classification.

- 5

Provide your address and taxpayer identification number (TIN).

- 6

Sign the form using the simple electronic signature tool.

- 7

Click Done to download the completed form.

This website is not affiliated with IRS

Who is required to fill out a W-9 form?

Form W-9 is primarily filled out by freelancers, independent contractors, and vendors to provide their Taxpayer Identification Number (TIN) to entities that pay them.

Businesses and financial institutions use the completed Form W-9 to report income paid to contractors and to manage tax reporting to the IRS.

When is a W-9 form not required?

Certain individuals may not need to complete a W-9 form. For example, those who are not engaged in an employment relationship or independent contractor work within the United States might not require filling out this form.

Additionally, non-residents performing work outside the U.S. typically do not need to submit a W-9. It's designed primarily for U.S. persons, including citizens and residents, to provide their taxpayer identification numbers to entities that pay them.

When is a W-9 form due?

The deadline for submitting a W-9 form is typically upon request by the individual or entity that requires your tax information for reporting purposes. There's not a specific due date, but it's important to provide it promptly when asked.

Submitting your W-9 form in a timely manner ensures compliance with tax reporting requirements and helps avoid potential delays or issues with payments.

How to get a blank W-9 form?

For those needing to complete a W-9 form, our platform offers a blank template already loaded in our editor, ensuring you can start filling it out right away without the need to download it elsewhere. Remember, while PDF Guru assists in filling out and downloading the form, it doesn't support submitting it.

How to sign W-9 form online?

To sign a W-9 form online with PDF Guru, start by filling out the necessary fields. Once completed, look for the signature option.

PDF Guru allows for the creation of simple electronic signatures. Follow the prompts to add your signature to the W-9 form, then download it.

Where to file a W-9?

To submit a W-9, send it directly to the requester. It is not sent to the IRS. Ensure the form's accuracy before mailing to avoid any issues with payment or reporting.

This website is not affiliated with IRS